In a global context in which exotic fruit production continues to grow, analysing the profiles of consumers of these types of fruit, new or established, is important for operators right along the fruit and vegetable production chain. Crop, processing and marketing prospects are all shaped by the consumer.

For several years now exotic fruit has no longer encompassed just bananas and pineapples but a wide range of different varieties that have made their way onto the shelves of retailers, some more aggressively than others. Outlets among which the wholesale market is a trailblazer for sales of exotic fruit, currently accounting for 85%* of total national domestic consumption purchases (*excluding bananas and pineapples). A percentage that falls slightly to 78% for the avocado, the most prominent tropical fruit, which will be analysed on 6 May at MacFrut during the Tropical Fruit Congress.

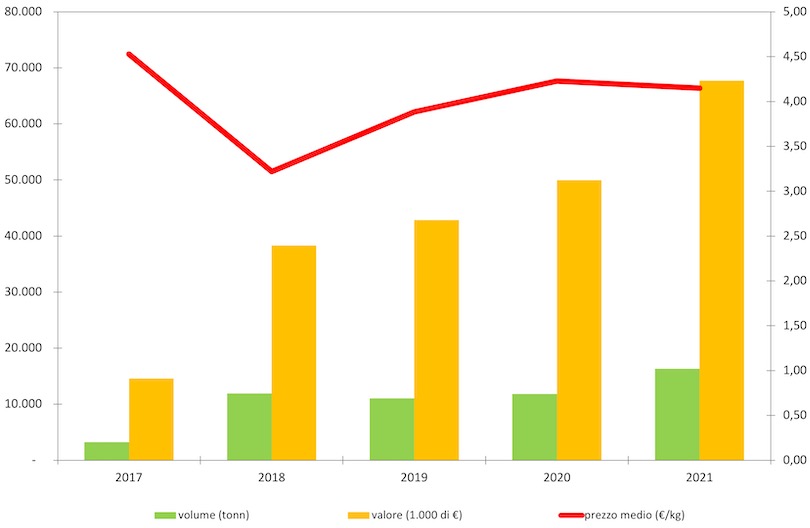

The avocado is acquiring an increasingly important role, not just among exotic fruits but also in terms of products traditionally purchased by Italian households: excluding the world of processed products and out-of-home consumption, in 2021 Italian families purchased around 67,000 tonnes of the product, a 35% increase in volume compared with the previous year. According to the GfK Italia data processed by CSO Italy, different consumption aspects are showing growth, including unit consumption per household and spend per family, which has risen by 55% in five years.

A widely popular fruit, contrary to the general perception, which attracts an adult customer base, with 28% of volumes consumed in 2021 attributable to buyers aged 65 and over. In addition, 23 out of 100 buyers in this age range put avocado on their shopping list with a prospective penetration index growth rate of several percentage points in the years to come.

A popular fruit across the age ranges, particularly so among more mature consumers, the avocado is also increasing its presence among households that include children (under-15s). This is once again borne out by the penetration data: whereas in 2020 families including an “under-15″ that purchased at least one avocado numbered 20 out of 100, in 2021 this number rose to 26. And that’s not all: in just a year the volume consumed per household rose by around 400 grams which out of a total of 2.5 kg equates to an increase of 18%.

Faced with the growing demand for avocados, the supply chain will therefore have to adapt, not just in terms of cultivation, processing, logistics and distribution, but also as regards the consumers to whom the fruit will be marketed, a public that is willing to spend money but at the same time demands ripe, tasty avocados which, if possible, are exotic in name only, not origin